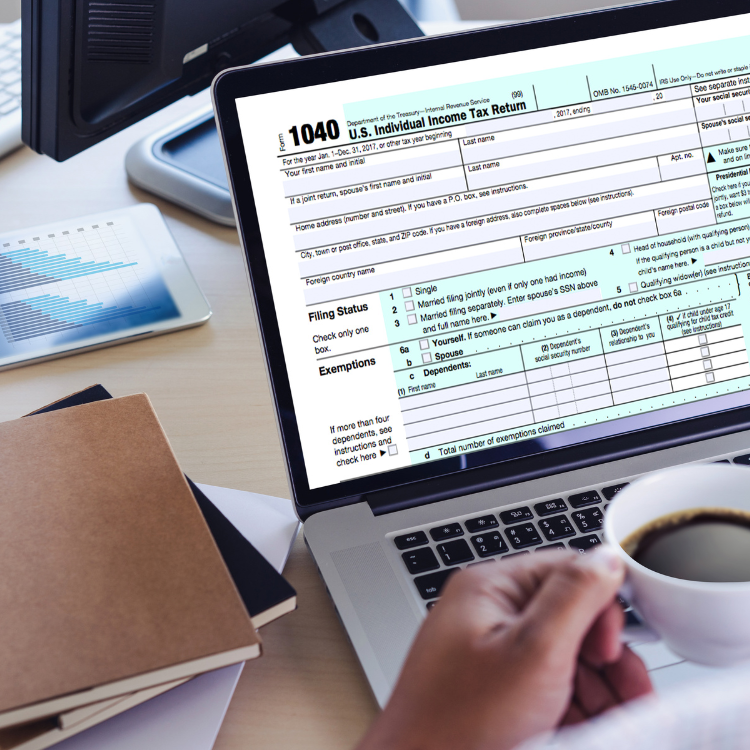

Tax Accountants: Roles and Responsibilities

Tax accountants are specialized professionals within the accounting field. Their main responsibility is preparing and examining financial tax statements, ensuring compliance with tax laws and regulations, creating strategies to reduce tax liabilities, and offering guidance on tax-related issues. They can work for both businesses and individuals and are experts in federal, state, and local tax codes.

Tax accountants can also represent clients during audits by tax authorities, help with the financial planning to minimize tax obligations, and complete filings that are both timely and accurate. Furthermore, they stay updated on tax legislation changes, which can significantly impact their clients’ financial state.

Education and Certification Requirements

The typical entry requirement for a career as a tax accountant is a bachelor’s degree in accounting or a related field. Some employers might prefer candidates with a master’s degree in accounting or taxation. Courses typically cover areas of business, economics, mathematics, and specific tax-related topics.

Besides the educational background, getting certified as a Certified Public Accountant (CPA) significantly increases job prospects, earning potential, and credibility in the field. The CPA exam is administered by the American Institute of Certified Public Accountants (AICPA) and requires considerable study and preparation.

Moreover, some tax accountants may also choose to become an Enrolled Agent (EA), a federally-authorized tax practitioner who has technical expertise in the field of taxation and can represent taxpayers before all administrative levels of the Internal Revenue Service.

Wages and Salary

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for accountants and auditors was $73,560 in May 2020. However, wages for tax accountants can vary greatly depending on factors like location, years of experience, level of education, and the complexity of the work they handle.

Typically, tax accountants with advanced degrees or certifications such as CPA or EA can expect to earn more than those without these credentials. Also, those who work in major metropolitan areas or for large corporations generally have higher earning potential.

Career Outlook

The BLS projects that employment of accountants and auditors is projected to grow 7 percent from 2020 to 2030, about as fast as the average for all occupations. As long as there are taxes, there will be a demand for tax accountants. Furthermore, changes in tax laws and regulations, the increasing complexity of the tax code, and an aging population requiring more tax assistance all suggest strong future demand for tax accounting services.

In conclusion, tax accountants play an indispensable role in the smooth financial functioning of both businesses and individuals. They require a solid educational background and often, specific certifications. While the work can be complex, it offers competitive wages and a positive job growth outlook.